Wygraliśmy 641 spraw z bankami:

Wygraliśmy 641 spraw z:

Kancelaria procesowa Warszawa | Rachelski & Wspolnicy

Help for Swiss franc borrowers

Are you struggling with a loan in Swiss francs? Take advantage of our help!

An effective way to free yourself from a loan is to take the matter to court. We will help you free yourself from the loan, and in the case of overpaid capital, we will recover the funds from the Bank. After the successful completion of the court case, we offer our free assistance in settlements with the Bank, help in deleting the mortgage and guarantee free recovery of your overpaid money. Don't wait, regain control over your finances and your life. Send your contract for free analysis! Make an appointment for a free consultation. Our Swiss franc office is located in Warsaw.

Help for Swiss franc borrowers

Banking law experts

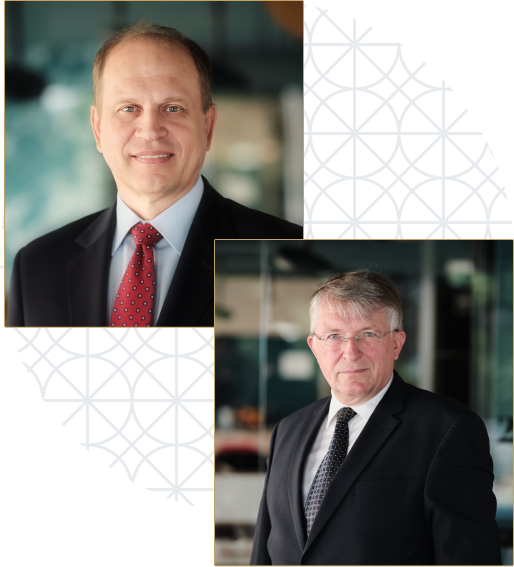

Stanisław Rachelski

Legal Counsel

Wojciech Ostrowski

Legal Counsel

The law firm's team consists of experienced patrons, experts and analysts who have been successful in thousands of cases. Thanks to our knowledge and experience, we guarantee help and comprehensive support at every stage of cooperation. By choosing us, you focus on professionalism and effectiveness. We invite you to cooperate - let our knowledge and experience become your advantage!

30

years of experience

19

professionals

641

won cases

100%

won final cases

How does the release process work?

free analysis

We will analyze your loan agreement free of charge

signing a contract

we will give you full support and care of a dedicated Patron

lawsuit

we will prepare and submit a lawsuit to court on your behalf

representation

we represent you in court at the hearing

free settlement

We will help you settle your accounts with the bank and cancel your mortgage free of charge

Benefits of cooperation

Cancellation of the contract

Cancellation is the best solution because not only do you free yourself from the loan, but you can also recover the money overpaid in excess of the principal amount. This allows borrowers to return to normal life and start a new life without a loan. You have loan in CHF? Our law firm in Warsaw will help you invalidate the contract.

Effective help from a recognized expert

We guarantee you access to recognized and proven experts who will help you free yourself from toxic credit. We are with you throughout the entire court process and even a day longer. We invalidate the contract, then we help, free of charge, as part of the contract, to settle accounts with the Bank, recover the overpaid money from the bank and cancel the mortgage. Our Swiss franc law firm is very effective in winning cases.

Reliable Help and Support – from start to finish and one day longer.

With our law firm, you are not alone in any phase of the court process. We offer you continuous support - we are with you at every stage, ready for any challenges and questions that may arise during our cooperation. After the successful completion of the court case, we offer our free assistance in settlements with the Bank, help in deleting the mortgage and guarantee free recovery of your overpaid money. We are a law firm specializing in Swiss franc loans.

Cases won by our law firm

Our winnings in numbers

win against BPH SA

Won by a married couple with children who took out a loan in May 2005. Represented by the Rachelski & Wspólnicy Law Firm against BPH SA

Klaudia Krzyżanowska

Perfect Customer Advisor

Nazywam się Klaudia i będę wspierać Cię na każdym etapie tego procesu. Jeśli masz jakiekolwiek pytania lub chciałbyś ocenić swoje szanse na wygraną, śmiało skontaktuj się ze mną – jestem tu, by Ci pomóc. Możesz do mnie zadzwonić lub napisać wiadomość.

Loan taken out

PLN 296,208.01

Debt

PLN 280,297.65

Already paid off

PLN 299,625.65

Benefit after case

+ PLN 45,315.00

Duration

2.5 years